"The Most Unbelievable Tax Break Ever" - Forbes Magazine

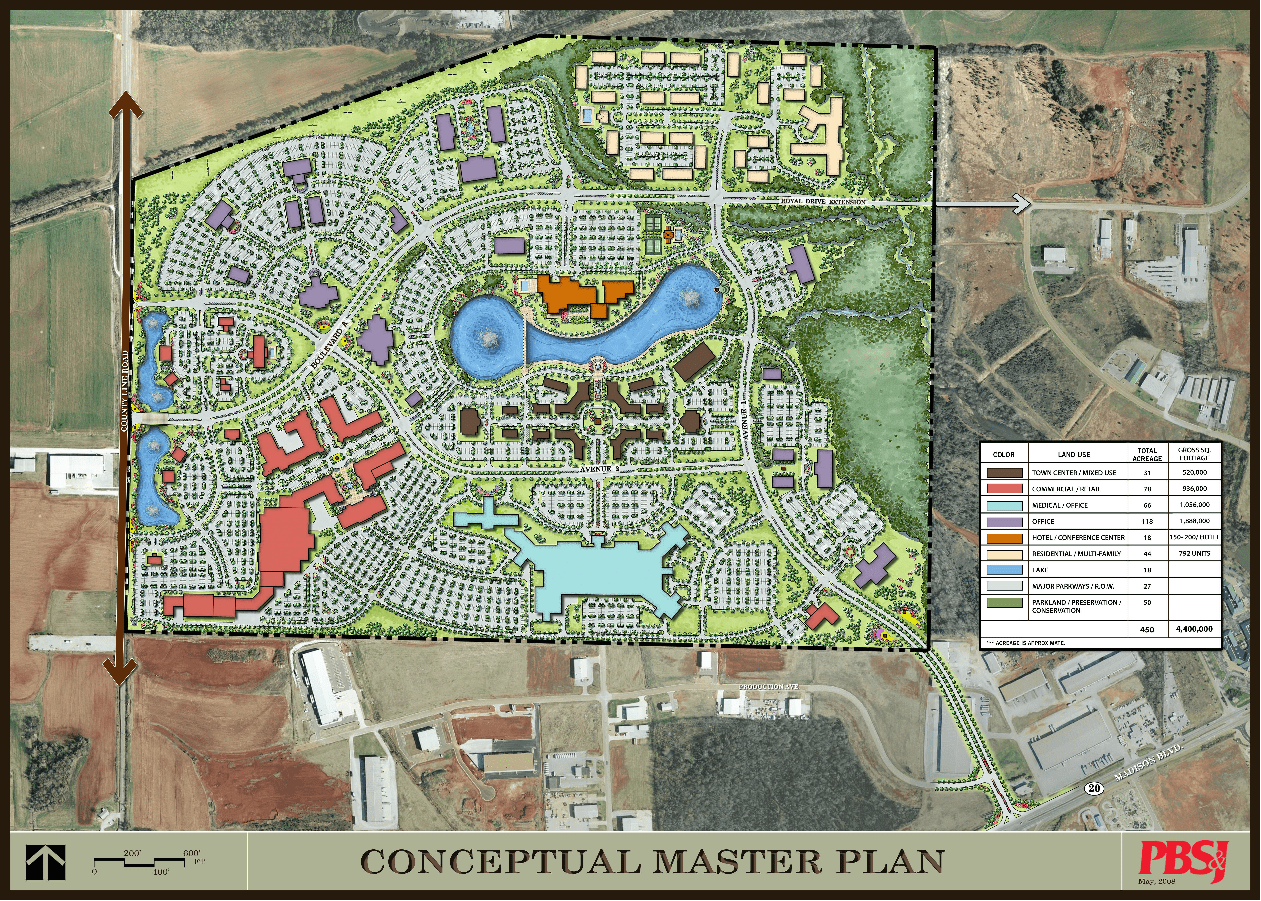

Is my project in an Opportunity Zone?

Check your address against the IRS-approved interactive Opportunity Zone map provided by CDFI Fund. Click the button below.

Opportunity Zones' Biggest Myths

America's corporate tax rate is no longer the most controversial part of the Tax Cuts and Jobs Act of 2017.